Carbon Tax FAQs

What is a carbon tax?

A carbon tax is a fee imposed on carbon pollution, usually increasing at a predictable rate over time. The tax is paid upstream by the producers of fossil fuels (i.e. at the mine, pipeline, or refinery). The goal of a carbon tax is to reduce greenhouse gas emissions using the power of price signals and free enterprise.

Why is a carbon tax needed?

Today’s energy market is broken. Due to subsidies, fossil fuels are artificially cheap, obstructing the market and preventing a level playing field. Industries pollute our skies for free, a massive hidden subsidy in addition to the breaks they received back in the day when the U.S. was trying to promote oil and gas development. Climate damages stemming from carbon dioxide emissions cost the U.S. billions each year and the American public is left to foot the bill. A carbon tax would internalize negative externalities by adding some health and climate damages to the price of fossil fuels. This accountability would shatter the illusion that energy from fossil fuels is cheap. Given the correct price signals, consumers and producers would be incentivized to switch, quickly, to cleaner energy alternatives.

Aren’t taxes bad?

It depends. Just like with any policy, a poorly designed carbon tax can be harmful to the economy. But a well-designed carbon tax will reduce our use of dirty fuels while spurring innovation and economic growth. If something is bad for society, it makes sense to tax it so we have less of it. In contrast to convoluted, big-government regulations, a well-designed carbon tax is a simple, effective, small-government way to address climate change. At republicEn, we favor a carbon tax that is both revenue neutral and border adjustable.

What does “revenue neutral” mean?

With a revenue-neutral carbon tax, the government does not keep the money raised from the tax, which means the government does not grow. Instead, 100% of the tax revenue goes back to the American people. This may be done by offsetting taxes elsewhere (e.g. cutting payroll or income tax) or by sending dividend payments to households.

What does “border adjustable” mean?

A border-adjustable carbon tax imposes a fee on imports from countries that don’t have a comparable price on carbon pollution. That way, American firms are not disadvantaged against countries without a carbon tax or tempted to outsource to these countries. This border adjustment helps keep the U.S. competitive in the global market, as well as entices our trading partners to enact their own carbon tax policy.

How is a carbon tax fiscally conservative?

At its core, a carbon tax is a market-driven solution. Solving climate change requires the innovation, speed, and creativity that only comes from free-enterprise capitalism, and a carbon tax accelerates this process. A carbon tax is transparent and predictable, allowing industry to pivot and plan for the future instead of getting bogged down by ineffective subsidies and regulations. It internalizes negative externalities, and also opens the door to repealing burdensome environmental regulations rendered unnecessary by the pollution fee. A carbon tax is the most conservative solution to climate change: simple, effective, and sensible.

Would a carbon tax actually work?

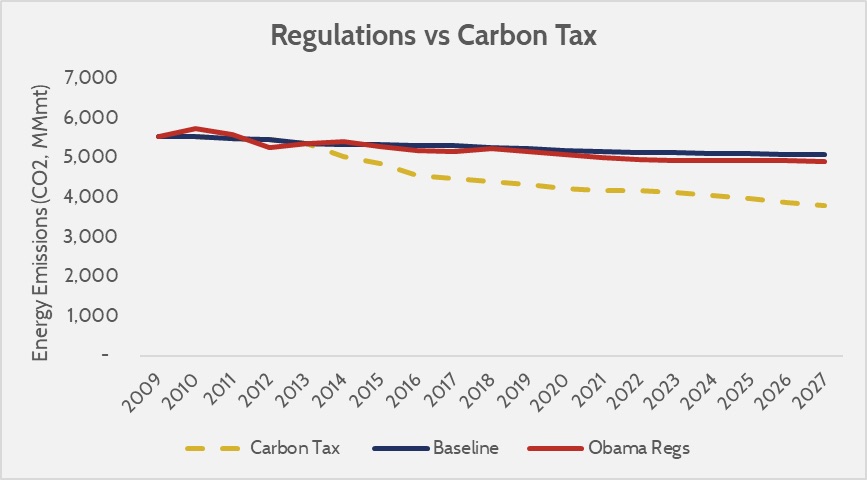

Yes. In a transparent, accountable energy market, consumers – not regulators, mandates, or fickle tax incentives – would drive demand for clean energy. Entrepreneurs would race to supply that demand, and we’d quickly shift to power our lives with the fuels of the future. Studies show that a carbon tax can reduce U.S. carbon emissions faster and more effectively than regulations.

Source: American Action Forum

Would a carbon tax increase energy prices?

Since a carbon tax would raise costs for fossil fuel producers, it would likely lead to higher energy prices for consumers (at least at first, until our economy transitions to clean energy sources). Researchers predict that a $25/ton carbon tax would cause the price of gasoline to go up about $0.21/gallon and the price of electricity to go up about $11/month for the average American household. This price increase is why it’s important for a carbon tax to be revenue neutral, returning the money to households. With money back in their pockets, Americans will be cushioned from the inevitable increase in energy prices.

Who supports carbon tax policy?

There is widespread agreement among economists that a carbon tax is the most cost-effective solution to address climate change. Many large energy companies, such as ExxonMobil and ConocoPhillips, have also endorsed a carbon tax. A growing number of U.S. politicians on both the sides of the aisle have pushed for carbon pricing legislation.

Notable conservative-led carbon tax proposals in the United States:

- Raise Wages, Cut Carbon Act (2009): Introduced in the House by Rep. Bob Inglis (R-SC) and co-sponsored by Rep. Jeff Flake (R-AZ) and Dan Lipinski (D-IL). Would have implemented a revenue-neutral carbon tax in exchange for equivalent cuts in payroll taxes. (Reintroduced by Rep. Lipinski in 2019.)

- MARKET CHOICE Act (2018): Introduced in the House by Rep. Carlos Curbelo (R-FL) and co-sponsored by Reps. Brian Fitzpatrick (R-PA) and Francis Rooney (R-FL). Would implement a carbon tax paired with a repeal of the gasoline tax and with revenue designated mainly for infrastructure projects. (Reintroduced by Rep. Fitzpatrick in 2019 and 2021.)

- Energy Innovation and Carbon Dividend Act (2019): Introduced in the House by Reps. Francis Rooney (R-FL), Ted Deutch (D-FL), and five more Democratic members. Would implement a revenue-neutral carbon tax with all revenue returned to Americans in the form of dividend checks.

- Stemming Warming and Augmenting Pay Act (2019): Introduced by Rep. Francis Rooney (R-FL). Would implement a $30 tax per metric ton of carbon with revenues paid out to individuals through payroll taxes.

- Climate Leadership Council Carbon Dividends Plan: Proposed by a coalition of respected conservatives including James Baker and George Shultz. Calls for a revenue-neutral carbon tax with all revenue returned to Americans in the form of dividend checks.

- Green Flat Tax: Proposed by economists Art Laffer and Stephen Moore. Calls for a carbon tax in exchange for a flat income tax of 18%.

What is “cap and trade”?

Cap and trade is similar to a carbon tax in the sense that it puts a price on carbon. A “cap” is set on the total amount of carbon emissions that major polluters can discharge. Each polluter gets the right to emit a certain amount of the total. Then “trading” is allowed, which means a company that can reduce its emissions can make a profit by selling its “extra” permits to a company having trouble reducing its emissions. The company that buys the permits wants to avoid that extra expense in the future, so it has the incentive to reduce pollution. “Cap and trade” is applied “upstream,” to large-scale industries such as refineries and power plants, so that smaller companies aren’t faced with a regulatory burden. Economists believe that either cap-and-trade or a carbon tax will benefit businesses and households in the long run by providing powerful incentives for green energy innovation. This market-based approach was successfully used by the Acid Rain Program in the early 1990s though subsequent attempts to apply cap and trade to carbon emissions have often funded government-growing programs, which is why we prefer a pure price on carbon and to let the market take it from there.

Are other countries doing anything about climate change?

The simple answer is yes. For example, the European Union countries have policies to put a price on carbon, and they are considering a carbon border adjustment, a fee charged to products being imported from countries with weaker carbon emissions programs. Most of the countries of the world are signatories to the Paris Climate Accord, a voluntary commitment to reduce carbon emissions. Because CO2 emitted from anywhere is mixed together in the planet’s atmosphere, it’s a global problem.

Doesn’t the war in Ukraine show that we still need fossil fuels?

We certainly do! We need to use them more efficiently. Putting a price on carbon will create strong incentives for efficiency and innovation. The war in Ukraine has reminded freedom-loving countries that it’s risky to depend on petro-dictatorships like Russia. If we transform the energy system, we can defund and defang people like Vladimir Putin.

More carbon tax resources:

- What You Need to Know About a Federal Carbon Tax in the United States (Columbia University Center on Global Energy Policy)

- Carbon Taxes: The Most Efficient Way to Reduce Emissions (Hoover Institution)

- Where Carbon is Taxed (Carbon Tax Center)

- Climate Leadership Council

- Citizens’ Climate Lobby